Percorso 1

L'avventura

della moneta

10 sale per muovere i primi passi nel mondo degli strumenti di pagamento e della finanza, a partire dalla loro nascita fino a oggi.

Il Percorso

Il sistema monetario e finanziario ha origini molto antiche.

Dal pagamento in orzo o metalli preziosi all'istituzione delle banche centrali sono passati migliaia di anni, ricchi di invenzioni incredibili, aneddoti curiosi e fatti storici.

L'avventura della moneta li ripercorre in un viaggio immersivo attraverso i tempi, per scoprire come siamo arrivati fin qui.

Dalla nascita della moneta a oggi

10 sale al piano terra di Villa Hüffer e nell'adiacente palazzina di via Milano per muovere i primi passi nel mondo degli strumenti di pagamento e della finanza, a partire dalla loro nascita fino a oggi.

Le Sale del Percorso

-

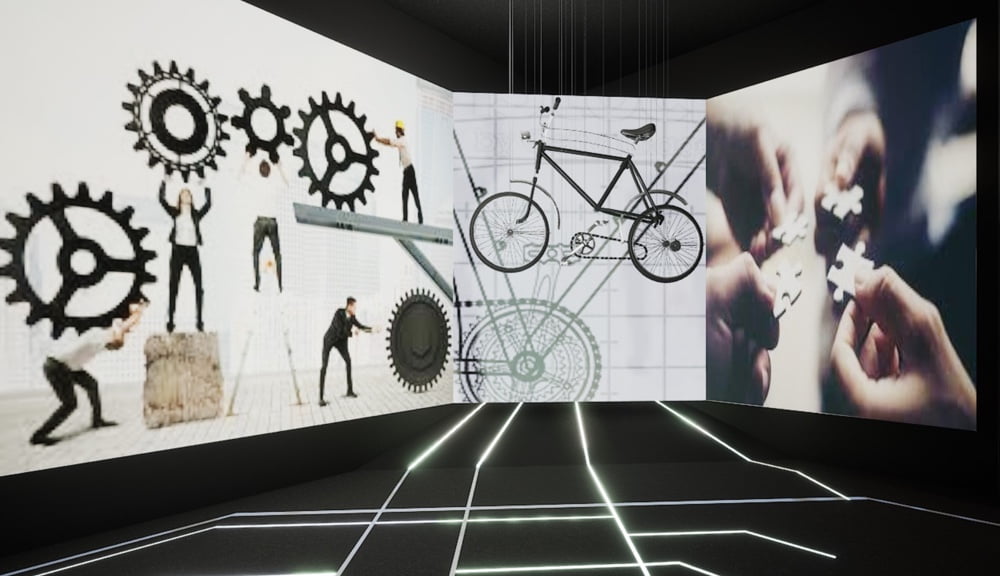

Sala 1Il sistema invisibile Introduzione alla moneta

Giochi di luce illuminano le parti di una bicicletta sospesa nel vuoto. Il racconto della storia che ha portato alla costruzione della bicicletta è la metafora della rete di collaborazioni invisibili e del complesso meccanismo alla base del funzionamento dell'economia.

-

Sala 2La nascita della finanza Mesopotamia: le prime operazioni economiche e finanziarie

Il percorso inizia dall'antica Mesopotamia, che 5mila anni fa fu la culla della più antica società complessa della storia. Qui fu usata la prima forma di scrittura per registrare le operazioni economiche e finanziarie.

-

Sala 3La nascita della moneta coniata Grecia e Roma: da oggetti e materiali di scambio alla prima moneta

L'avventura della moneta prosegue fino all'antica Grecia, teatro della diffusione della moneta coniata, che diventa, già nel VII e nel VI secolo a.C. simbolo del potere dei sovrani. Un'invenzione eccezionale, destinata a sostituire tutti i mezzi di pagamento usati precedentemente, come l'orzo o i pezzi di metallo prezioso. È però la civiltà romana - qualche secolo dopo - a fare della moneta, insieme agli eserciti, il suo punto di forza.

-

Sala 4Banche private e banchi pubblici L'Italia tra Trecento e Seicento: le prime banche

Dopo una tappa nella Roma imperiale, il viaggio continua nella Toscana della seconda metà del Trecento, arricchita dal commercio e dalla lavorazione della lana. Sono gli anni in cui in Italia nacquero le prime banche moderne, che presto si diffusero nel resto d'Europa. Proseguendo si scopre che tra Trecento e Seicento i più grandi clienti dei mercanti-banchieri italiani erano i sovrani europei. Fu a causa delle loro inadempienze che a Napoli, Venezia, Genova e altre città italiane, nacquero i banchi pubblici, antenati delle moderne banche centrali.

-

Sala 5Rivoluzione industriale e mercati finanziari Il mondo moderno tra sviluppo e rischi

Arrivata la Rivoluzione Industriale, l'avventura della moneta rivela attraverso i tempi come le nuove forme di energia e lo sviluppo dei mercati finanziari generino una grande crescita, ma allo stesso tempo provochino nuovi problemi e rischi.

-

Sala 6Le lezioni del Novecento Inflazione e deflazione come indicatori di stabilità sociale

Il cammino prosegue e giunge in Germania, ai primi decenni del Novecento, tra aumento dei prezzi e crisi economica del 1929, terreno fertile per la nascita del Nazismo. Le conseguenze arrivarono: la Seconda guerra mondiale e le sue tragedie, la distruzione e la sconfitta del Paese.

-

Sala 7Il Bal Tic Tac Le feste futuriste

In quegli anni, nel novembre 1921, fu inaugurata una delle prime sale da ballo pubbliche italiane, il Bal Tic Tac, completamente decorata in stile futurista dal grande artista Giacomo Balla. La sala, venuta alla luce durante i lavori per la realizzazione del MUDEM, traghetta al giorno d'oggi.

-

Sala 8La finanza come macchina del tempo Alla scoperta del funzionamento degli strumenti finanziari

Conclusa la parte storica, il viaggio continua nel presente con la sala de La finanza come macchina del tempo, dove capire il funzionamento degli strumenti finanziari e perché possono essere definiti "promesse di pagamento".

-

Sala 9La finanza mondiale e le banche centrali L'importanza di determinate istituzioni per contrastare rischi e instabilità

L'avventura della moneta attraverso i tempi continua con un'analisi di mezzi e sistemi di pagamento, stabili ed efficienti, progettati per proteggere il valore della moneta e del risparmio.

-

Sala 10Le funzioni della Banca d'Italia e dell'Eurosistema Come proteggere il valore della moneta e del risparmio

Nell'ultima sala il visitatore scopre il livello aggregato della moneta e il ruolo che la Banca d'Italia e l'Eurosistema svolgono per contrastare i rischi di fragilità e instabilità finanziaria.